sales tax calculator anaheim

Sales Tax Calculator. Check your city tax rate from here Thats it you can now get the tax amount as well as the final amount which includes the tax too Method to calculate Anaheim sales tax in 2021.

How To Calculate Sales Tax Sales Tax Tax Sales And Marketing

Anaheim is in the following zip codes.

. Historical Sales Tax Rates for Anaheim 2021 2020 2019 2018. Enter your Amount in the respected text field. Calculate sales tax Free rates.

In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller. There is no applicable city tax. Your Anaheim cafe or restaurant may require a general license for all types of alcoholic beverages or a license just for beer and wine.

Wine cider or spirits youre likely going to need some type of beverage alcohol license. Calculate a simple single sales tax and a total based on the entered tax percentage. The 775 sales tax rate in Anaheim consists of 6 California state sales tax 025 Orange County sales tax and 15 Special tax.

Sales tax total amount of sale x sales tax rate Wise is the cheaper faster way to send money abroad. Sales tax is calculated by multiplying the purchase price by the sales tax rate to get the amount of sales tax due. Fast Easy Tax Solutions.

The County sales tax rate is. How to use Anaheim Sales Tax Calculator. Wayfair Inc affect California.

We found 3000 results for Sales Tax Calculator in or near Anaheim CA. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Anaheim CA. For tax rates in other cities see California sales taxes by city and county.

Decide what drinks your business plans to sell and learn the licenses you need. Did South Dakota v. Use this calculator the find the amount paid on sales tax on an item and the total amount of the purchase.

Anaheim CA Sales Tax Rate Anaheim CA Sales Tax Rate The current total local sales tax rate in Anaheim CA is 7750. Sales Tax Breakdown Anaheim Details Anaheim CA is in Orange County. Choose the Sales Tax Rate from the drop-down list.

The Anaheim sales tax rate is. California CA Sales Tax Rates by City A The state sales tax rate in California is 7250. Want to pay your sales tax via direct debit.

The minimum combined 2021 sales tax rate for Anaheim California is. You can print a 775 sales tax table here. This is the total of state county and city sales tax rates.

Technically tax brackets end at 123 and there is a 1 tax on personal income over 1 million. Look up the current sales and use tax rate by address. 101 rows The 92806 Anaheim California general sales tax rate is 775.

For State Use and Local Taxes use State and Local Sales Tax Calculator. For a list of your current and historical rates go to the California City County Sales Use Tax Rates webpage. 101 rows The 92850 Anaheim California general sales tax rate is 8.

Net Price is the tag price or list price before any sales taxes are applied. The sales tax rate is always 8 The sales tax rate is always 8 Every 2014 combined rates mentioned above are the results of California state rate 65 the county rate 1 and in some case special rate 05. The combined rate used in this calculator 775 is the result of the California state rate 6 the 92806s county rate 025 and in some case special rate 15.

92801 92802 92803. Rate variation The 92806s tax rate may change depending of the type of purchase. With local taxes the total sales tax rate is between 7250 and 10750.

Some areas may have more than one district tax in effect. Ad Find Out Sales Tax Rates For Free. Sellers are required to report and pay the applicable district taxes for their taxable.

This rate is made up of a base rate of 6 plus California adds a mandatory local rate of 125 that goes directly to city and county tax officials. The Anaheim California general sales tax rate is 65. California sales tax details.

Depending on local sales tax jurisdictions the. As part of the Mental Health Services Act this tax provides funding for mental health programs in the state. The statewide tax rate is 725.

They also appear in other related business categories including Tax Return Preparation-Business Taxes-Consultants Representatives and Bookkeeping. The sales tax added to the original purchase price produces the total cost of the purchase. California City County Sales Use Tax Rates effective January 1 2022 These rates may be outdated.

The California sales tax rate is currently. Total Price is the final amount paid including sales tax. The businesses listed also serve surrounding cities and neighborhoods including Los Angeles CA Santa Ana CA and Long Beach CA.

Use the sales tax formula below or the handy calculator at the top of the page to get the tax detail you need. Exporting or importing goods from abroad to sell in the US. Sales Tax Calculator Sales Tax Table Sales Tax Table.

Those district tax rates range from 010 to 100. The California state sales tax rate is 725. In all there are 10 official income tax brackets in California with rates ranging from as low as 1 up to 133.

The December 2020 total local sales tax rate was also 7750. If you frequently need the sales tax.

Sales Tax Anaheim Tax Services Ca

Food And Sales Tax 2020 In California Heather

Food And Sales Tax 2020 In California Heather

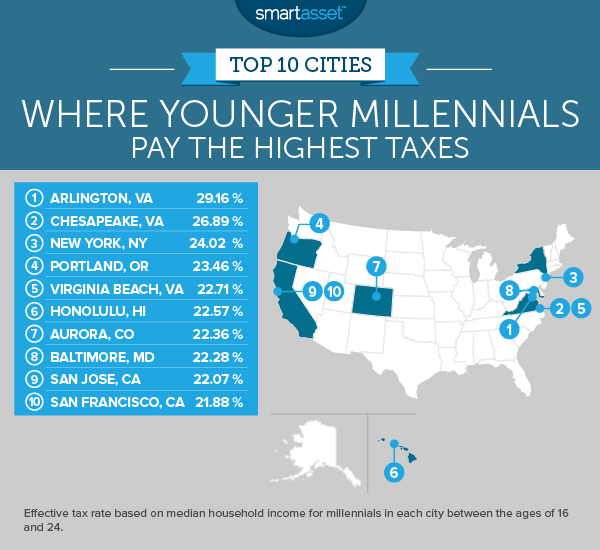

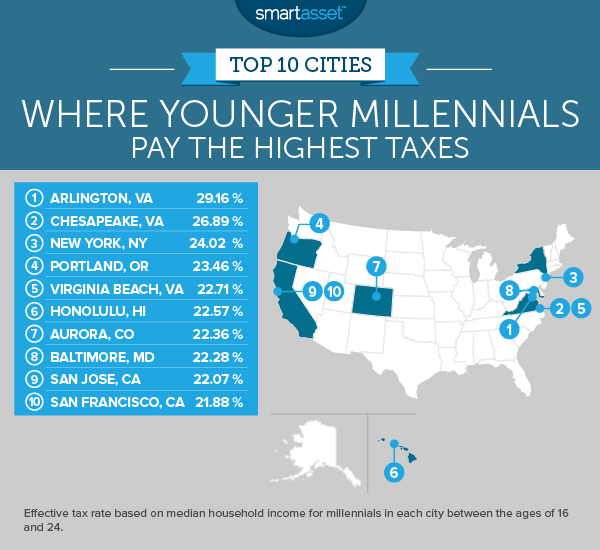

Where Millennials Pay The Highest Taxes 2017 Edition Smartasset

Sales Tax Anaheim Tax Services Ca

California Sales Tax Rates By City County 2022

6 75 Sales Tax Calculator Template Sales Tax Tax Printables Tax