tax sheltered annuity limits 2021

The IRS recently announced the 2021 contribution limits for the UW Tax-Sheltered Annuity TSA 403 b Program and the Wisconsin Deferred Compensation WDC 457 Program. For example if you contributed 3000 over the plan contribution limit for five years.

403 B Contribution Limits For 2021 And 2022 The Motley Fool

If you are age 50 or older in 2021 and.

. Earned Self-employment if spending 20 hoursweek or more managing the property. Annuitization Giving up control to the insurance company. Diversity Equity.

If both the age 50 and the 15-year catch-up provisions are available any contributions that exceed the 20500 annual limit for 2022 or 19500 for 2021 will first be. Retirement savings contributions credit. Unearned if spending less than 20 hoursweek managing the property.

There are 3 ways to generate an income stream from an annuity. W There is a lifetime limit of 15000 with each additional contribution you make applied toward that limit. For 2021 the adjusted gross income limitations have increased from 65000 to 66000 for married filing jointly filers.

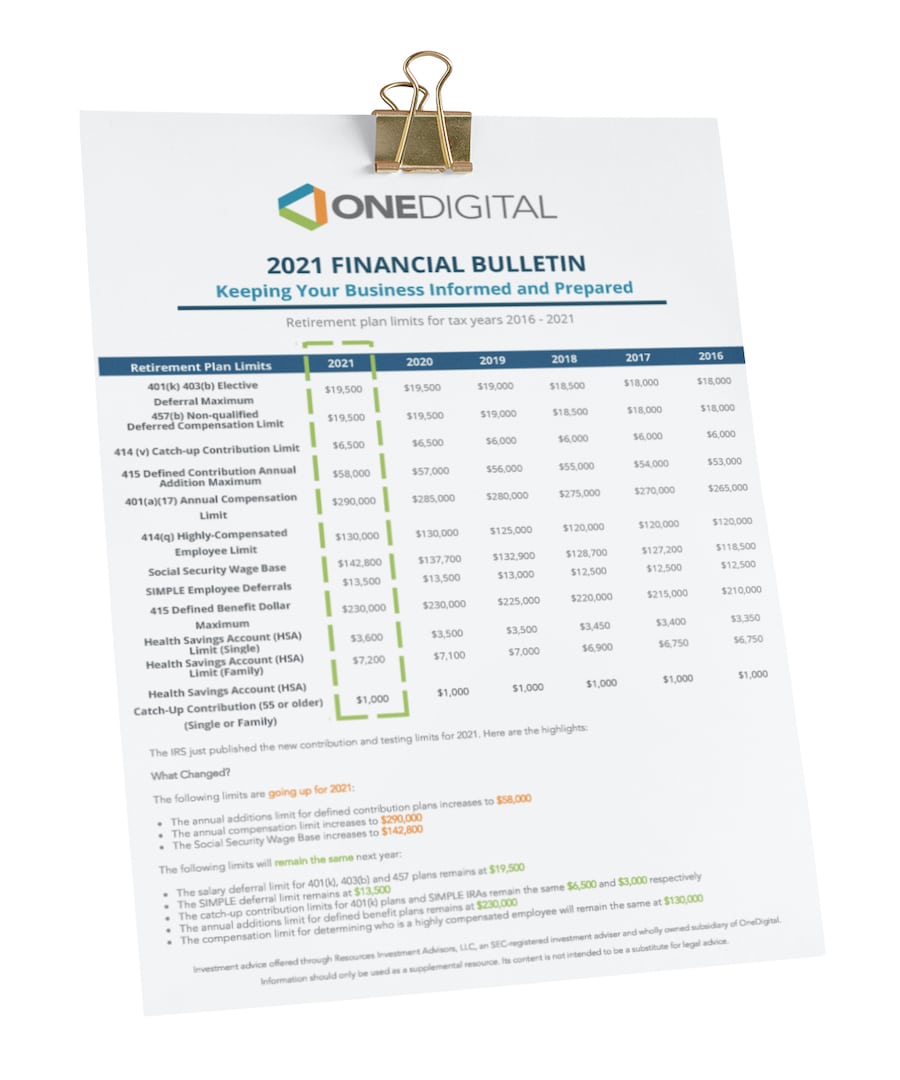

For State Employees Civil Service Board. The Internal Revenue Service IRS announced yesterday October 26 2020 the following dollar limits applicable to tax-qualified plans for 2021. Whats New for 2021.

NSHE Tax Sheltered Annuities 403b Plan Regular Contribution Limits 50 Catch-Up Additional Contribution Limits. Just as with a. The best MYGA and fixed annuity rates are 515 percent for a 7-year surrender period 450 percent for a ten-year surrender period 515 percent for a five-year surrender period and 525.

For 2021 the most you can contribute to your TDA is 195003 However depending on your age and your years of service your maximum may be higher. The limit on the maximum. Lifetime Withdrawals Providing you with control over your income.

The applicable utility allowance must then be deducted from the applicable Maximum Tax Credit Rent Limit to determine the maximum rent that can be paid by a Resident. A 403b plan tax-sheltered annuity plan or TSA is a retirement plan offered by public schools and certain charities. Its similar to a 401k plan maintained by a for-profit entity.

/GettyImages-1131086835-83fd238d51f44798943a4e69c1198537.jpg)

457 Plan Vs 403 B Plan What S The Difference

Sec 403 B Retirement Plans A Comparison With 401 K Plans

Tax Planning For Retirement Ameriprise Financial

Tax Sheltered Annuity Faqs Employee Benefits

Insurancenewsnet Magazine December 2021 By Insurancenewsnet Issuu

2021 2022 Utsaver Retirement Plans The Best Value By Ut System Office Of Employee Benefits Issuu

The Benefits Of A 403 B Retirement Plan Sdg Accountants

457 Plan Vs 403 B Plan What S The Difference

Sec 457 Government Plan Distributions Compared To 401 K Distributions

2021 Retirement Plan Contribution Limits Onedigital

Retirement Savings Tsas Tax Sheltered Annuity Plans North Marion School District Or

What Is A 403 B Retirement Plan Contributions Withdrawals Taxes

2022 2023 401k 403b 457 Ira Fsa Hsa Contribution Limits

What S The Difference Between Qualified And Non Qualified Annuities

403b Vs 401k Two Ways To Save For Retirement Stash Learn

Tax Benefits Of Retirement Accounts Comparing 401 K S 403 B S And Iras Turbotax Tax Tips Videos

The Tax Sheltered Annuity Tsa 403 B Plan

Publication 560 2021 Retirement Plans For Small Business Internal Revenue Service